Next-Generation Sequencing (NGS) Market — 2025 snapshot and outlook

Executive summary — Next-generation sequencing (NGS) continues to be one of the fastest-growing segments in life sciences, driven by expanding clinical use (oncology, rare disease diagnostics), falling per-sample costs, growth in single-cell and long-read applications, and rising outsourcing and data-analysis services. Market estimates vary by source, but professional reports agree the market is in a multibillion-dollar growth phase with double-digit compound annual growth rates through the late 2020s.

Buy Now Report :https://m2squareconsultancy.com/purchase/284

Download A Sample Report HERE : https://m2squareconsultancy.com/reports/next-generation-sequencing-market

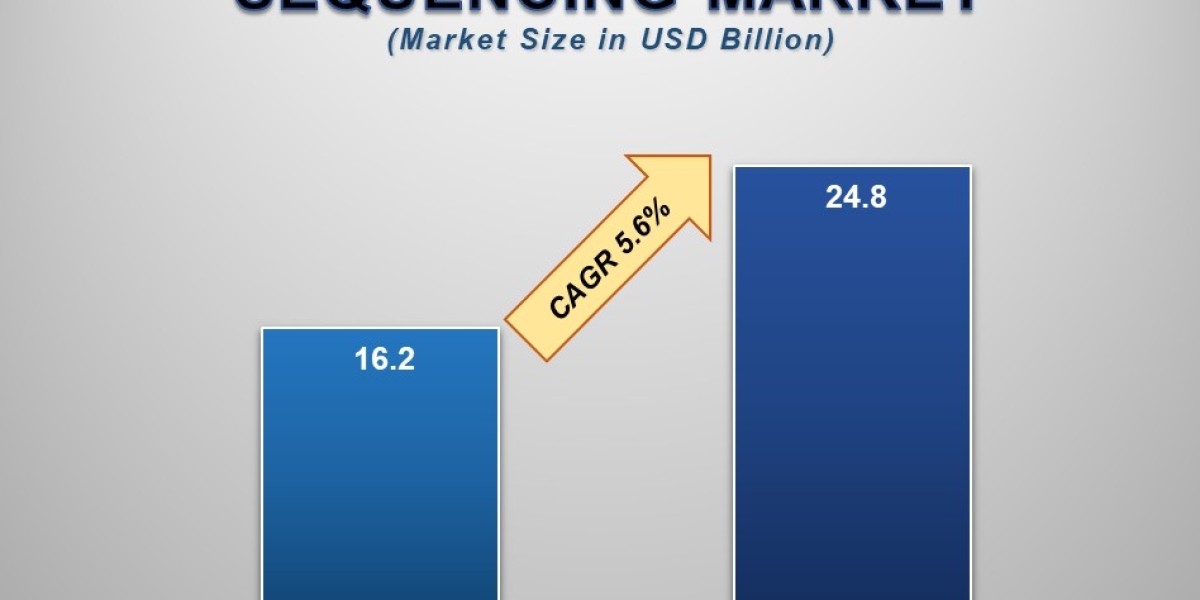

Market size & growth (what the numbers say)

Published market reports give different baselines and forecasts depending on scope and methodology:

Grand View Research estimated the global NGS market at ~USD 8.4 billion in 2023, projecting growth to ~USD 33.2 billion by 2030 (CAGR ≈ 21.7% for 2024–2030).

Other respected sources provide alternative figures (examples: Fortune Business Insights and MarketsandMarkets), with forecasts spanning mid-teens to low-20s percentage CAGR and 2025 market values ranging from roughly USD 9–12 billion across reports.

Takeaway: exact dollar figures vary by report (scope, included product groups, services vs. instruments), but consensus: NGS is a rapidly expanding market driven by clinical adoption and new technology categories.

Key growth drivers

Clinical adoption in oncology and rare disease testing. Increasing use of NGS for tumor profiling, minimal residual disease monitoring, and hereditary diagnostics is pushing demand for clinical-grade assays and instruments.

Declining sequencing costs and instrument diversification. New benchtop and lower-cost platforms make in-house sequencing feasible for smaller labs and hospitals, expanding the addressable market beyond large research centers. Recent instrument launches and kit partnerships are accelerating this trend.

Emergence of long-read & single-cell sequencing. Long-read platforms (Oxford Nanopore, PacBio) and single-cell workflows are opening new clinical and research applications (structural variant detection, improved isoform analysis, complex microbial genomics).

Data and services economy. As datasets grow, demand for bioinformatics, cloud analysis, and outsourced sequencing services rises—creating a sizable adjacent market for analytics and interpretation.

Major players & competitive landscape

The market is competitive but somewhat concentrated among a handful of established suppliers and fast followers:

Illumina — still a dominant player in short-read platforms and sequencing consumables; active in partnerships and kit development.

Thermo Fisher Scientific — broad portfolio across sequencers and clinical workflows.

Oxford Nanopore Technologies & Pacific Biosciences (PacBio) — leaders in long-read sequencing; both pursuing clinical and pharma markets. Recent leadership and strategy changes at Oxford Nanopore have been in the news.

BGI, 10x Genomics, QIAGEN, Azenta (Genewiz) — important players in sequencing services, single-cell, and library/prep workflows.

Note: competitive dynamics are shifting as lower-cost benchtop instruments, partnerships with academic centers, and kit/service bundles change where sequencing is performed (centralized core vs. decentralized clinical labs).

Regional picture

North America remains the largest regional market (research infrastructure, clinical adoption, biotech/pharma activity), followed by Europe and Asia-Pacific. Growth in Asia (China, India, Japan) is notable due to rising domestic sequencing service providers and government genomics initiatives.

Trends to watch (2025–2030)

Clinical sequencing scaling: wider reimbursement and clinical validation will determine speed of clinical market penetration.

Decentralization: more hospitals and diagnostic labs buying benchtop sequencers and running targeted panels in-house.

Integration of AI and cloud pipelines for faster interpretation and reporting—data-analysis is becoming as important as instruments.

Consolidation & partnerships: M&A and strategic alliances (kits, reagents, informatics) will continue as firms try to offer end-to-end solutions.

Challenges & risks

Data management and regulatory hurdles (privacy, CLIA/FDA for diagnostics) slow clinical rollout.

Reagent supply & pricing pressure — sequencing is sensitive to consumable costs; pricing competition compresses vendor margins.

Market estimate variability — different reports use different definitions (instruments only vs. instruments + services + reagents), so stakeholders should align on scope when using market numbers.

Strategic recommendations

For instrument vendors: invest in lower-cost, clinical-grade workflows, and bundled software to win decentralized clinical buyers.

For service providers / CROs: scale cloud analytics and interpretation services; target oncology and rare-disease pipelines.

For investors: prioritize companies with defensible software/analytics and differentiated chemistry (long-read, single-cell) over pure instrument play—market leadership will hinge on integrated solutions.

Conclusion

NGS is moving from a high-value research technology into a clinical and commercial infrastructure layer for modern medicine and biotech. While precise market figures vary by source, every major market report and industry development shows robust, multi-year growth driven by clinical adoption, technology diversification (single-cell and long-read), and a burgeoning data/services economy. Stakeholders who combine reliable instruments, validated clinical workflows, and scalable analytics stand to capture the largest share of the market value being created through 2030.

To Summarize the Key Highlights of this Report:

https://m2squareconsultancy.com/reports/collaborative-robot-market

https://m2squareconsultancy.com/reports/wearable-medical-devices-market

https://m2squareconsultancy.com/reports/global-energy-drinks-market

https://m2squareconsultancy.com/reports/immersion-cooling-market

https://m2squareconsultancy.com/reports/electric-vehicle-charging-infrastructure-market

https://m2squareconsultancy.com/reports/critical-infrastructure-protection-market

https://m2squareconsultancy.com/reports/std-diagnostics-market

https://m2squareconsultancy.com/reports/stem-cell-therapy-market

https://m2squareconsultancy.com/reports/oncology-drugs-market

https://m2squareconsultancy.com/reports/organoids-market

https://m2squareconsultancy.com/reports/magnetic-resonance-imaging-coils-market

https://m2squareconsultancy.com/reports/organic-personal-care-products-market

https://m2squareconsultancy.com/reports/portable-power-station-market

https://m2squareconsultancy.com/reports/power-transformer-market

https://m2squareconsultancy.com/reports/renewable-energy-market

https://m2squareconsultancy.com/reports/artificial-sweeteners-market

https://m2squareconsultancy.com/reports/blister-packaging-market

https://m2squareconsultancy.com/reports/digital-therapeutics-market

https://m2squareconsultancy.com/reports/drug-discovery-outsourcing-market

https://m2squareconsultancy.com/reports/e-pharmacy-market

https://m2squareconsultancy.com/reports/edible-oil-market

https://m2squareconsultancy.com/reports/medical-simulations-market

https://m2squareconsultancy.com/reports/medical-coding-market

https://m2squareconsultancy.com/reports/surgical-microscopes-market

https://m2squareconsultancy.com/reports/surgical-robots-market

https://m2squareconsultancy.com/reports/ultomiris-drug-market

https://m2squareconsultancy.com/reports/global-insulin-pump-market

https://m2squareconsultancy.com/reports/human-microbiome-market

https://m2squareconsultancy.com/reports/solar-panel-operation-and-maintenance-market

https://m2squareconsultancy.com/reports/premium-chocolate-and-confectionery-market

https://m2squareconsultancy.com/reports/health-and-wellness-snacks-market

https://m2squareconsultancy.com/reports/fruit-and-vegetable-pulp-market

https://m2squareconsultancy.com/reports/dehydrated-vegetables-market

Strategic Outlook

- Focus on scaling up domestic production and recycling to reduce import dependence.

- Leverage AI-powered energy management platforms.

- Expand utility and behind-the-meter deployments to meet renewable integration needs.

- Invest in next-generation chemistries to improve performance and lower lifecycle costs.

About m2squareconsultancy :

We are a purpose-driven market research and consulting company passionate about turning data into direction. Founded in 2023, we bring together researchers, strategists, and data scientists who believe that intelligence isn’t just about numbers, it’s about insight that sparks progress.

We cater to a wide range of industries by delivering customized solutions, strategic insights, and innovative support that help organizations grow, adapt, and lead in their respective sectors. Here’s a brief overview of key industries we work with

Contact Us:

Email: sales@m2squareconsultancy.com

Phone (IN): +91 80978 74280

Phone (US): +1 929 447 0100