When was the last time you wished you could look ahead and see financial challenges before they hit your books? If you’re like most accountants, business owners, or CFOs, the answer is every single day. Predicting the financial future has always been tricky, but thanks to AI-powered predictive analytics in accounting, we’re no longer just reacting to numbers—we’re anticipating them.

Today, we’ll break down 15 practical ways predictive analytics is reshaping accounting and why it matters for you, your clients, and your business’s future. But first, let’s ground ourselves in what predictive analytics really means in the accounting world.

What is Predictive Analytics in Accounting, and Why Should You Care?

Predictive analytics isn’t about pulling numbers from thin air—it’s about using historical data, AI algorithms, and statistical models to forecast what’s coming next. Think of it as having a financial radar that warns you about risks, opportunities, or cash flow crunches long before they happen.

For accountants and CAs, this means fewer surprises during audits, smoother forecasting, and the ability to guide clients with hard data instead of just intuition. For businesses, it translates into better financial planning, smarter investments, and fewer sleepless nights worrying about liquidity.

How Can Predictive Analytics Improve Cash Flow Management?

Cash flow has always been the beating heart of any business. Without it, even profitable companies collapse. With AI-powered tools, you can:

Predict late payments by analyzing customer behavior and past patterns.

Forecast cash shortages weeks or months before they happen.

Optimize vendor payments to balance outflows and ensure liquidity.

Imagine being able to alert your client that they’ll face a ₹50 lakh shortfall in two months if current trends continue. Instead of scrambling for loans, they can adjust budgets today. That’s the power of AI in accounting.

How Do Predictive Models Help in Expense Forecasting?

Expenses often spiral out of control—not because businesses don’t plan, but because they don’t see the trends early enough. Predictive analytics can:

Flag recurring expense spikes (like seasonal electricity bills or logistics costs).

Compare vendor pricing and suggest better deals.

Help companies set realistic budgets rather than just “guesstimates.”

When accountants shift from record-keepers to financial strategists, they become indispensable partners in business growth.

Can AI Reduce the Risk of Fraud and Errors?

Yes, and it’s one of the biggest benefits. Traditional accounting relies on sampling, but AI-driven predictive analytics scans 100% of financial transactions for anomalies. It can:

Detect unusual payment timings.

Flag duplicate invoices.

Spot deviations from normal spending behavior.

In a profession where 99.9% accuracy is the gold standard, predictive analytics doesn’t just help—it transforms.

How Do Businesses Use Predictive Analytics for Revenue Forecasting?

Revenue forecasting used to be like reading tea leaves—plenty of guesswork, little certainty. With predictive analytics, you can:

Factor in seasonal trends.

Adjust projections based on market conditions.

Incorporate real-time sales and marketing data.

For example, if a retail company historically earns 40% of its revenue in festive months, AI models can forecast how current consumer demand may shift those percentages. That gives management clarity on inventory, staffing, and capital allocation.

Why Is Customer Behavior Prediction a Game-Changer?

Accounting is no longer limited to ledgers—it’s about insights that help businesses thrive. By analyzing customer payment patterns, purchase history, and churn risks, accountants can advise businesses on:

Which customers are most likely to default.

Which markets are worth expanding into.

How to align financial strategies with customer trends.

This turns accountants from number crunchers into business growth advisors.

How Can Predictive Analytics Strengthen Audit Preparedness?

Audits are stressful—but predictive analytics makes them smoother. Here’s how:

Automated anomaly detection ensures fewer surprises during audits.

Predictive models can identify accounts most likely to require adjustments.

AI reduces human errors, making financial statements cleaner and audit-ready.

This means fewer sleepless nights for accountants and faster, more transparent audits for businesses.

Can Predictive Analytics Help With Tax Planning?

Absolutely. AI models analyze historical tax data, changing regulations, and business patterns to:

Forecast tax liabilities months ahead.

Suggest optimal tax-saving opportunities.

Flag risks of non-compliance.

Instead of rushing in March, accountants can spread out tax planning throughout the year, easing both workload and stress.

How Do Accountants Use Predictive Analytics for Risk Management?

Businesses face countless risks—market volatility, inflation, supply chain disruptions. Predictive analytics empowers accountants to:

Simulate multiple financial scenarios.

Quantify risk exposure.

Recommend proactive measures.

This isn’t just accounting—it’s financial strategy consulting at its best.

Can Predictive Analytics Make Budgeting More Reliable?

Yes, because budgets shouldn’t be based on hope—they should be based on data. Predictive analytics allows:

Rolling budgets that adapt as new data flows in.

Department-level forecasts to avoid overspending.

Data-backed budget approvals rather than guesswork.

For CFOs, this means greater confidence in strategic decision-making.

How Can Predictive Analytics Improve Supplier and Vendor Management?

By tracking vendor pricing, delivery reliability, and payment cycles, predictive analytics can:

Suggest cost-saving vendor switches.

Forecast supply chain bottlenecks.

Optimize procurement schedules.

This ensures companies don’t just save money but also build stronger, more reliable supply networks.

What Role Does Predictive Analytics Play in Strategic Planning?

Strategic planning requires a clear financial map. Predictive analytics provides:

Forecasts that go beyond quarterly numbers.

Long-term financial impact analysis of investments.

Insights into which initiatives deliver the highest ROI.

Instead of reacting to trends, businesses can proactively set strategies with confidence.

Can Predictive Analytics Drive Better Investment Decisions?

Yes. AI models analyze market movements, historical returns, and business cycles to guide:

Investment timing.

Portfolio allocation.

Risk diversification strategies.

This empowers accountants to advise clients on where to put their money, when, and how much.

How Does Predictive Analytics Enhance Employee Productivity in Finance Teams?

Manual tasks drain energy. Predictive analytics automates repetitive work and lets finance teams focus on:

Strategic planning.

High-value client advisory.

Continuous monitoring of risks and opportunities.

This leads to a happier, more productive workforce—and satisfied clients.

Why Should You Trust VouchrIt for AI-Powered Predictive Analytics in Accounting?

Now that you’ve seen the 15 ways predictive analytics reshapes accounting, the big question is: Who can deliver this transformation reliably? That’s where VouchrIt steps in.

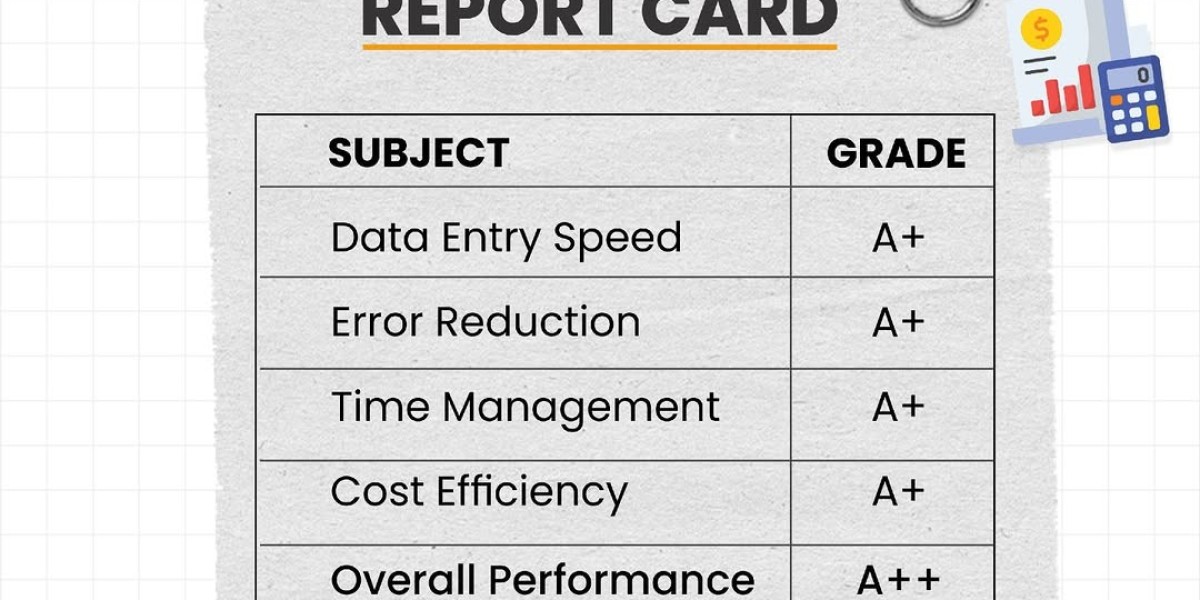

12,000+ CAs & accountants already trust the platform.

90% of manual data entry eliminated, freeing accountants to focus on strategy.

20M+ vouchers processed with 99.9% accuracy.

Security-first design, ensuring every client’s financial data stays safe.

Unlike generic AI tools, VouchrIt is built with accountants in mind—seamlessly integrating with Tally, prioritizing compliance, and offering an intuitive interface that doesn’t require technical skills.

When you combine predictive analytics with VouchrIt’s automation, you don’t just get smarter accounting—you get future-proof accounting.

Final Thoughts: Are You Ready to Forecast Before Others React?

Financial surprises are costly. Businesses that adopt AI-powered predictive analytics in accounting don’t just avoid those surprises—they gain a competitive advantage.

Whether it’s predicting cash flow gaps, reducing fraud, or guiding strategic investments, predictive analytics makes accountants and businesses stronger, faster, and more future-ready.

So, the question is simple: Will you wait for financial shocks, or will you forecast and prepare with AI?

If you’re ready to transform your accounting workflow, join the 10,000+ professionals who trust VouchrIt. The future of accounting isn’t just about recording numbers—it’s about predicting them.